i-Account - How to Perform First Time Bank Reconciliation

Introduction

For i-Account users, reconciling the bank records in the system against the actual bank statement is an important monthly task. Admins can use the bank reconciliation function in the system to complete this process.

For i-Account users, reconciling the bank records in the system against the actual bank statement is an important monthly task. Admins can use the bank reconciliation function in the system to complete this process.

Refer below for a guide on starting the first month bank reconciliation.

How To Perform First Month End Reconciliation

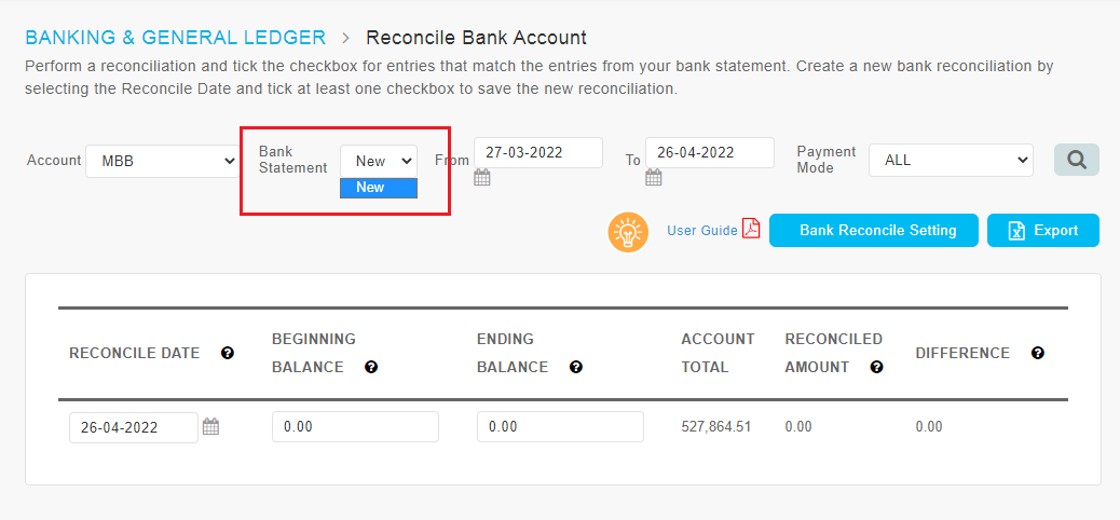

1. Go to Banking and General Ledger > Transactions > Reconcile Bank Account to start the first month end reconciliation.

2. First, select the relevant bank account from the Account dropdown menu.

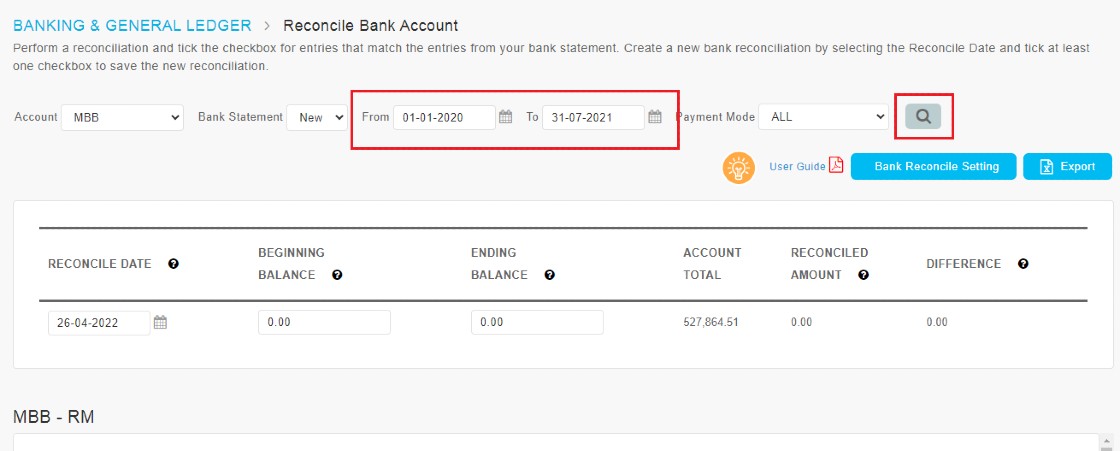

4. Next, choose the From and To dates. Choose an appropriate date range to ensure all transactions in the system are included in the listing below.

From: Choose the date of the earliest transaction in the system. For example, if the earliest transaction is for the migration date of June 30th 2021, you can select that date or even much earlier such as January 1st 2020.

To: Choose the reconciliation date, e.g., July 31st 2021.

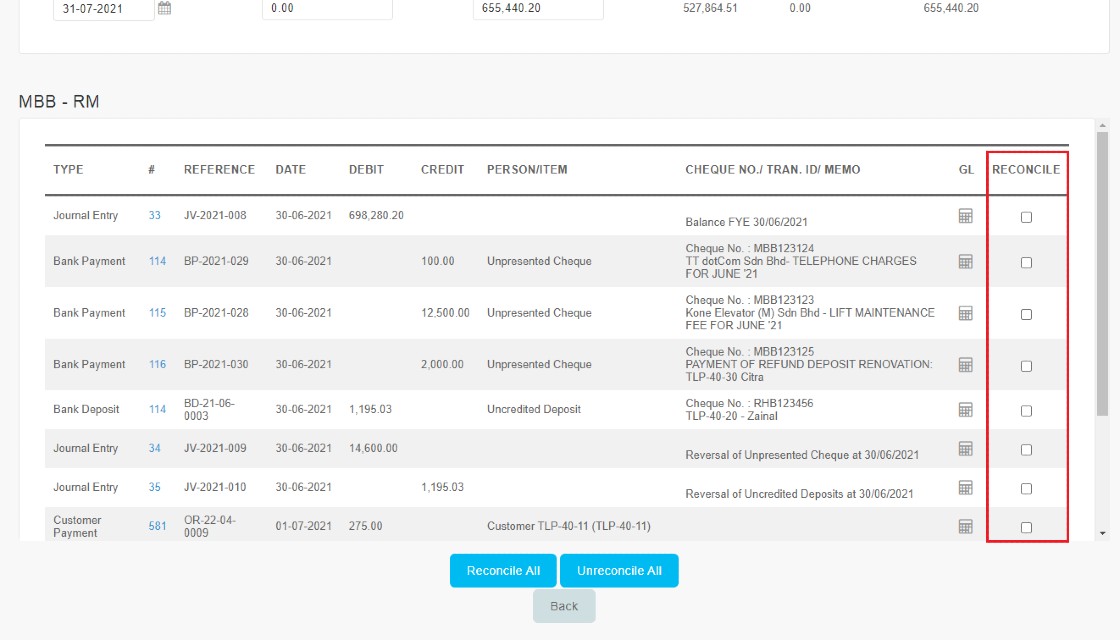

5. Next, under Reconcile Date, select the reconciliation date (e.g., July 31st 2021). Enter the Ending Balance (balance in actual bank statement on the reconciliation date). Tick at least one checkbox in the transaction listing below to save this page.

Note: Do not key in any value for Beginning Balance (leave as 0.00 for first month reconciliation). This balance is auto brought forward from the previous month reconciliation.

6. Scroll down to view the list of transactions within the selected date range.

7. Check if there are any opening balance entries and unreconciled items on the migration date (e.g., June 30th 2021). Tick the Reconcile checkbox based on the following conditions:

i: Journal Entry for the Bank GL opening balance on the migration date (e.g., June 30th 2021) – Tick

ii: Unpresented cheques & Uncredited deposits on the migration date – Tick only if already cleared in the bank on reconciliation date (31 July 2021). Do not tick if it still remains uncleared.

iii: Journal entry for reversal of Unpresented cheques & Uncredited deposits on the migration date - Tick

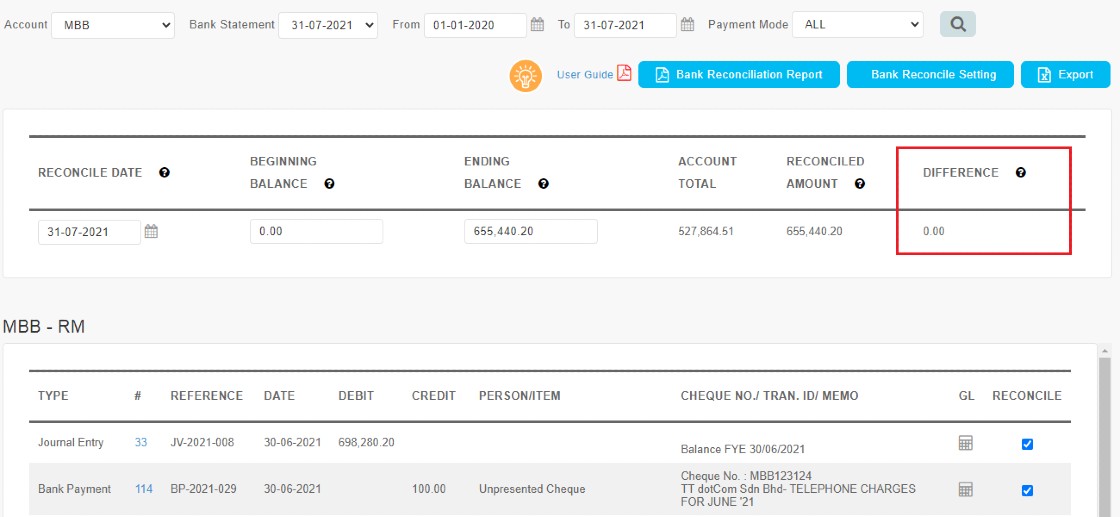

8. Next, reconcile for the first month transactions. Every time you tick (untick) a checkbox, the page will be auto-saved.

i: Tick all the receipts and payments shown in the transaction listing if they match the actual bank statement (cleared the bank).

ii: Enter any receipts or payments (e.g., bank interest/ bank charges) appearing on the bank statement, which have not yet been recorded into the system record.

iii: Rectify any differences found for a transaction between the system and bank records (e.g., wrongly keyed in values, duplicate entries etc.).

i: Tick all the receipts and payments shown in the transaction listing if they match the actual bank statement (cleared the bank).

ii: Enter any receipts or payments (e.g., bank interest/ bank charges) appearing on the bank statement, which have not yet been recorded into the system record.

iii: Rectify any differences found for a transaction between the system and bank records (e.g., wrongly keyed in values, duplicate entries etc.).

10. After completing the reconciliation, you can download the Bank Reconciliation Statement by clicking on “Bank Reconciliation Report”. The same statement can also be generated at Reports > Banking > Bank Reconciliation Report.

This is a very detailed instruction and it will help me a lot.

ReplyDeleteHey Fingertec community! I've been reading through the insightful comments on performing first-time i-Account setups, and it got me thinking about the importance of a well-equipped workspace. If you're looking to spruce up your desk, I found this fantastic collection of stationery images on Depositphotos. A clutter-free desk with quality stationery can significantly boost productivity and add a touch of creativity to your work routine. Check out the link and explore the variety of options they offer. Feel free to share your favorite stationery items or any tips you have for maintaining an organized workspace. Let's make our work environments not just functional but inspiring too!

ReplyDelete